Calzone

Gear Whore #1

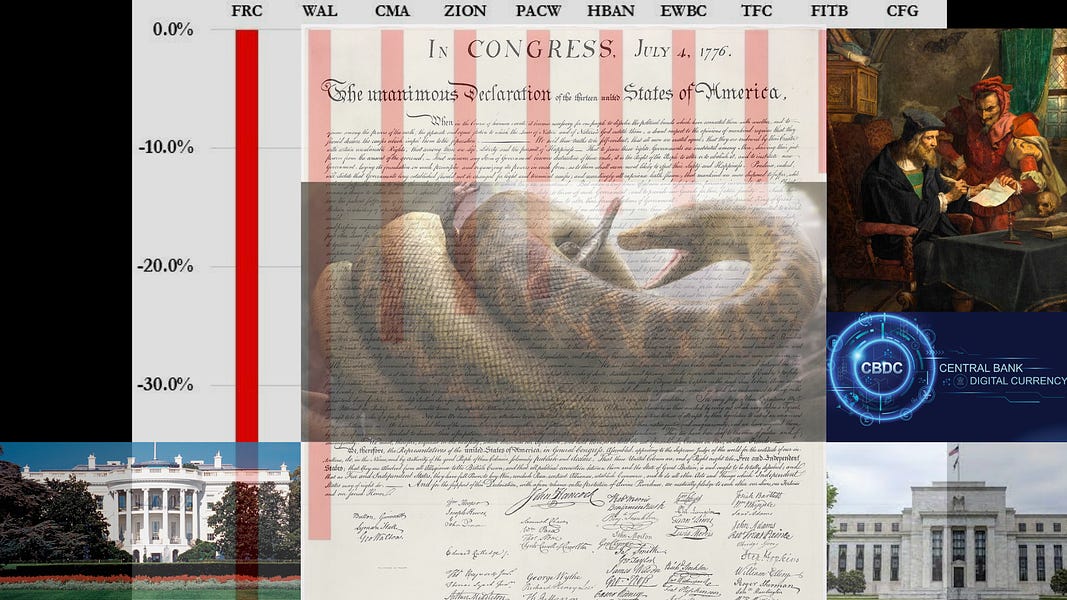

WOW. The markets reacted today as if the overhang of loses in long-term bonds in other banks don’t matter.

The FED is a bit cornered. It needs to raise rates .5% to fight inflation, but that would likely create more runs on more banks.

This is like an “E” Ticket Ride at Disneyland.

So let’s see of there is a quarter point hike, or perhaps none.

Some people believe that now all deposits in all banks will be made “whole,” as if the government intended that to be true Policy.

In 2007-2008 they “Socialized” loses, but that can’t continue forever.

Cal

The FED is a bit cornered. It needs to raise rates .5% to fight inflation, but that would likely create more runs on more banks.

This is like an “E” Ticket Ride at Disneyland.

So let’s see of there is a quarter point hike, or perhaps none.

Some people believe that now all deposits in all banks will be made “whole,” as if the government intended that to be true Policy.

In 2007-2008 they “Socialized” loses, but that can’t continue forever.

Cal

Particular

a.k.a. CNNY, disassembler

Soooo, FED is going to be making .5% more cameras?The FED is a bit cornered. It needs to raise rates .5% to fight inflation

Calzone

Gear Whore #1

Devil Christian,

The FED is short for the U.S. Central Bank. Stop being a camera nerd. LOL.

The Washington Post just released a great report of how there was a 72 hour scramble to prevent another 2008 Financial Crisis. Pretty much we sidestepped and dodged a bullet, but if you read through the links Austin supplied we still remain in a minefield.

All we did is avoid an explosion, and like the metaphor we still remain in a minefield. One analyst suggests this is the “Enron-Moment” and the “World Com” moment has yet to come. Others are saying, “This is the canary in the coal mine.” Ray Dalio, also is in this camp, suggests the only way to remove the booby traps is for the FED to go into a loosening cycle.

This suggests that “Austin’s” links have good data that suggest that many banks still have too much exposure to U.S. long-term bonds. Raising rates further would yield similar results like applying pressure to a pimple: perhaps causing breakout of pimples where any could explode.

The FED is likely to keep March interest rates flat, pretty much too afraid to make any move, meanwhile this allows inflation to get further entrenched with the possibility of some acceleration in the rate of inflation since the last hike was only a quarter point.

So the analogy I will use for this is driving my A4 Audi on what is known as “The Goat Trail,” a cliff like road blasted into a granite mountain overlooking the Hudson River.

It seems those clever German engineers specifically designed the car around a Pirelli P-7 low profile tire that runs at high pressures: 36 PSI front; and 38 PSI rear. These tires have very low rolling resistance because not only are the sidewalls small; the high pressure stiffens them further; and there is no loss of energy through squiggle.

The net effect is with out power the force of gravity alone can easily accelerate the Audi.

So we are on a road that is not just hilly, it is a mountain, there are mucho turns as the road hugs the mountain on man made cliffs.

Then there are chutes where from 30 MPH where acceleration to 80 MPH happens rapidly without any application of the gas: pretty much “coasting” and letting gravity take over. Very akin the feeling of being on a bicycle, but you are in a car.

There are lots of blind turns, and before entering the turn is when braking should be performed. Braking in a turn is just plain wrong and if you understand centrifugal force and how acceleration increases the footprint of a tire, and therefore provides more traction to a point, where too much acceleration could cause a loss of traction.

My Audi has a 7-speed automatic, and I kinda love more a manual tranny for its golf cart like direct drive where speed can be modulated with just one pedal using the engine for acceleration as well as braking. Know the Audi is AWD, it has oversized 4-wheel disc brakes; and really does well on a road like the “Goat Trail.”

Imagine now the FED is in an American SUV without the careful German engineering, and it tries to negotiate the Goat Trail in a vehicle that is less nimble than an Audi A4, but now the FED has no brakes, and the FED still has to still keep moving as fast as possible as if a graceful Audi.

The FED pretty much will avoid a crash as long as possible, but the road ahead is rather fraught. Somehow these images I draw out make it appear like a merge of two types of video games.

Cal

The FED is short for the U.S. Central Bank. Stop being a camera nerd. LOL.

The Washington Post just released a great report of how there was a 72 hour scramble to prevent another 2008 Financial Crisis. Pretty much we sidestepped and dodged a bullet, but if you read through the links Austin supplied we still remain in a minefield.

All we did is avoid an explosion, and like the metaphor we still remain in a minefield. One analyst suggests this is the “Enron-Moment” and the “World Com” moment has yet to come. Others are saying, “This is the canary in the coal mine.” Ray Dalio, also is in this camp, suggests the only way to remove the booby traps is for the FED to go into a loosening cycle.

This suggests that “Austin’s” links have good data that suggest that many banks still have too much exposure to U.S. long-term bonds. Raising rates further would yield similar results like applying pressure to a pimple: perhaps causing breakout of pimples where any could explode.

The FED is likely to keep March interest rates flat, pretty much too afraid to make any move, meanwhile this allows inflation to get further entrenched with the possibility of some acceleration in the rate of inflation since the last hike was only a quarter point.

So the analogy I will use for this is driving my A4 Audi on what is known as “The Goat Trail,” a cliff like road blasted into a granite mountain overlooking the Hudson River.

It seems those clever German engineers specifically designed the car around a Pirelli P-7 low profile tire that runs at high pressures: 36 PSI front; and 38 PSI rear. These tires have very low rolling resistance because not only are the sidewalls small; the high pressure stiffens them further; and there is no loss of energy through squiggle.

The net effect is with out power the force of gravity alone can easily accelerate the Audi.

So we are on a road that is not just hilly, it is a mountain, there are mucho turns as the road hugs the mountain on man made cliffs.

Then there are chutes where from 30 MPH where acceleration to 80 MPH happens rapidly without any application of the gas: pretty much “coasting” and letting gravity take over. Very akin the feeling of being on a bicycle, but you are in a car.

There are lots of blind turns, and before entering the turn is when braking should be performed. Braking in a turn is just plain wrong and if you understand centrifugal force and how acceleration increases the footprint of a tire, and therefore provides more traction to a point, where too much acceleration could cause a loss of traction.

My Audi has a 7-speed automatic, and I kinda love more a manual tranny for its golf cart like direct drive where speed can be modulated with just one pedal using the engine for acceleration as well as braking. Know the Audi is AWD, it has oversized 4-wheel disc brakes; and really does well on a road like the “Goat Trail.”

Imagine now the FED is in an American SUV without the careful German engineering, and it tries to negotiate the Goat Trail in a vehicle that is less nimble than an Audi A4, but now the FED has no brakes, and the FED still has to still keep moving as fast as possible as if a graceful Audi.

The FED pretty much will avoid a crash as long as possible, but the road ahead is rather fraught. Somehow these images I draw out make it appear like a merge of two types of video games.

Cal

Last edited:

Calzone

Gear Whore #1

It is 7:30 AM and DOW futures are down 500 points before the opening. Seems like Credit Suisse might explode and take out European banks.

Don’t know if the European bankers have 72 hours to handle this emergency like the Americans did.

So now too Europe is on my Goat Trail and in a minefield.

Here we go again. Will Credit Suisse explode? This can get ugly real fast.

Cal

Don’t know if the European bankers have 72 hours to handle this emergency like the Americans did.

So now too Europe is on my Goat Trail and in a minefield.

Here we go again. Will Credit Suisse explode? This can get ugly real fast.

Cal

Calzone

Gear Whore #1

WOW. Headline is Credit Suisse could be like Lehman.

Different but similar to SVB: a too concentrated investment led to a loss; then over a two year period books were fudged to hid the losses; so some lack of regulation on one hand, and on the other fraud.

The Saudi’s are heavily invested in Credit Suisse, but at maxed out in their position due to their own regulatory rules.

So another run, but on a big bank.

Tell me we don’t have a banking crisis.

Cal

Different but similar to SVB: a too concentrated investment led to a loss; then over a two year period books were fudged to hid the losses; so some lack of regulation on one hand, and on the other fraud.

The Saudi’s are heavily invested in Credit Suisse, but at maxed out in their position due to their own regulatory rules.

So another run, but on a big bank.

Tell me we don’t have a banking crisis.

Cal

Calzone

Gear Whore #1

DOW Futures now down over 600 points before the open.

Cal

Cal

Ko.Fe.

Lenses 35/21 Gears 46/20

Alan Greenspan came up with a term called “disinflation.”

Disinflation is how cheap goods got cheaper because of outsourcing and globalization under his tenure. Wages stayed low and stagnated, unions lost power, as middle class erosion began. This went on for decades, but is now played out.

One thing I did was not buy consumer goods at Walmart, Target, K-Mart that was more or less cheap goods from China. I knew there would be a price to pay later.

.....

We are all paying for fraud.

Cal

It is greed more than fraud.

Greed was/is to outsource manufacturing to elsewhere, where it is cheap labor. It creates rusted belt and empowers odd regimes.

Fraud is to make people believing how green is outsourcing to where pollution recreated even at more dangerous levels.

While Earth is not just as sphere anymore, but noosphere in bioshpere.

Our family friends moved from city to abandoned farm. They build industrial style building and needed to power it on. They could not find power distribution box anywhere in NA. Sold out. Ordered from China...

Calzone

Gear Whore #1

KoFe,

Thanks for the correction.

Unfortunately greed is running the world. Also the supply chain is so bad that I too have to buy stuff from China, I have a bad taste in my mouth…

Cal

Thanks for the correction.

Unfortunately greed is running the world. Also the supply chain is so bad that I too have to buy stuff from China, I have a bad taste in my mouth…

Cal

Austintatious

Well-known

Cal,

There was an excellent "Frontline" on PBS Tuesday evening, about the current banking crisis and the part that the Federal Reserve plays in it.

(they have basically caused it through mismanagement.)

I also came across this Substack post on the history of this global cartel of banksters known as the Central Bank world wide and the Federal Reserve here in the US. A very informative read.

jasonpowers.substack.com

jasonpowers.substack.com

There was an excellent "Frontline" on PBS Tuesday evening, about the current banking crisis and the part that the Federal Reserve plays in it.

(they have basically caused it through mismanagement.)

I also came across this Substack post on the history of this global cartel of banksters known as the Central Bank world wide and the Federal Reserve here in the US. A very informative read.

The American Banking Crisis & The Faustian Bargain to Come

Unless one was asleep, for a couple of days to three years, the United States had yet another crisis brewing to a froth over the past weekend. The results of Slaughterhouse Ten, those banks declining by -10% on the Casino Stock Exchange, will be ongoing amid the septuagenarian-led responses at the

Rodger

Newbie

I have had that Paramount for a long time, and it has gone through many iterations. In the first decade of this millennium, I spread the rear triangle to permit modern gearing. Now it runs 11s and, as you guessed, on 32mm tires. Not the lightest, not the fastest, but dear to my heart. I never took to mountain biking.Rodger,

How wide are those tires on that Paramount?

Also I took note that you are likely rather tall by the frame size.

Snarky Joe turned me onto Rene Herse tires. I have a Ti Basso (early rebranded Litespeed) mountain bike I set up with gravel tires 1.8”. It is set up as a 1x11 XTR currently, but will change over to a 2x11 with a 48/32 set of chainrings. These tires have low rolling resistance, and I love the smooth ride.

My forensics suggest that you might be older to have a retro bike. Is my guess correct. Know that I’m a speculator and smut queen.

Cal

Calzone

Gear Whore #1

A pleasant thought came to my mind when I thought about my Juki commercial sewing machine that I bought new with some zero APR finance deal brand new.

It happens to be one on the last Juki machines that was made in Japan and not in China.

It must be over 20 years old now… Anyways I’m glad I have it.

Did you know the best way to learn design, how to tailor, and how to sew well is to disassemble old clothes and reconstruct them.

Devil Christian might be onto something with his “Tag.”

Cal

It happens to be one on the last Juki machines that was made in Japan and not in China.

It must be over 20 years old now… Anyways I’m glad I have it.

Did you know the best way to learn design, how to tailor, and how to sew well is to disassemble old clothes and reconstruct them.

Devil Christian might be onto something with his “Tag.”

Cal

Calzone

Gear Whore #1

I was sympathetic to KoFe’s situation. In his context the offshoring was about greed, but it was also about policy (now failed government policy:globalization).

I had a problem resolving the added costs like shipping, building out infrastructure, and maintaining remote manufacturing and supply chains. Not sure how much policy underwrote these expenses. Anyways, all I’m suggesting is that these real expenses likely were offset in some manner that was likely supported by government policies. How did these logistics become cost feasible?

In less words government fostered and sponsored the greed that caused off-shoring. I know states and countries offer subsidies as teasers to invite business: like say building a Toyota plant in Ten-A-Cee. Part of this off shoring was incentives and tax breaks Or some form of preferential treatment.

My original context of fraud was in reference to the AAA ratings of CDO’s, and the business models that banks used like “Liar-Loans” and the “predatory lending” that was also fostered and condoned by governments.

While greed and fraud are two separate entities: one a sin; the other a crime: who pays the price?

My digging into the future suggests that the banking crisis really has not gone away. The backstopping is really like giving an I.V. to a bank that is wounded and bleeding. The unrealized loses on U.S. treasuries that banks are holding did not go away; The Swiss Nation Bank extending a line of credit did not fix the long-term problems at Credit Suisse.

It is suggested that the can was yet again kicked down the road, and in a year or two problems could return yet again. This is the new normal… Remember the words fraud and greed… Forget about regulation…

There is also some criticism that the backstopping has further emboldened the banks to continue risky behaviors, or even assume even more risk knowing that they now will be backstopped. Pretty much aggressive bad behavior is being encouraged.

I hope everyone knows and understands that we are in a mine field: explosion can happen at any time.

Cal

I had a problem resolving the added costs like shipping, building out infrastructure, and maintaining remote manufacturing and supply chains. Not sure how much policy underwrote these expenses. Anyways, all I’m suggesting is that these real expenses likely were offset in some manner that was likely supported by government policies. How did these logistics become cost feasible?

In less words government fostered and sponsored the greed that caused off-shoring. I know states and countries offer subsidies as teasers to invite business: like say building a Toyota plant in Ten-A-Cee. Part of this off shoring was incentives and tax breaks Or some form of preferential treatment.

My original context of fraud was in reference to the AAA ratings of CDO’s, and the business models that banks used like “Liar-Loans” and the “predatory lending” that was also fostered and condoned by governments.

While greed and fraud are two separate entities: one a sin; the other a crime: who pays the price?

My digging into the future suggests that the banking crisis really has not gone away. The backstopping is really like giving an I.V. to a bank that is wounded and bleeding. The unrealized loses on U.S. treasuries that banks are holding did not go away; The Swiss Nation Bank extending a line of credit did not fix the long-term problems at Credit Suisse.

It is suggested that the can was yet again kicked down the road, and in a year or two problems could return yet again. This is the new normal… Remember the words fraud and greed… Forget about regulation…

There is also some criticism that the backstopping has further emboldened the banks to continue risky behaviors, or even assume even more risk knowing that they now will be backstopped. Pretty much aggressive bad behavior is being encouraged.

I hope everyone knows and understands that we are in a mine field: explosion can happen at any time.

Cal

Last edited:

Calzone

Gear Whore #1

Rodger,

I love the retro spirit.

Also know that if I wanted a new bike I would buy one, but I think I love old bikes more because of history, bonding, and most of all because they are authentically cool.

Your bike now I look upon as a one off. Mucho cool.

Anyways because of my advancing age biking is not about going fast; it is about relaxing; staying fit; staying active; and having fun. Nothing wrong with going slow, and in fact long-slow-distance is likely the best training. In other words likely best to go on long relaxed rides for maximum health benefits.

I wish I could have my Ti Basso (Litespeed Classic) frame widened… My max tire width is a 28mm…

Cal

I love the retro spirit.

Also know that if I wanted a new bike I would buy one, but I think I love old bikes more because of history, bonding, and most of all because they are authentically cool.

Your bike now I look upon as a one off. Mucho cool.

Anyways because of my advancing age biking is not about going fast; it is about relaxing; staying fit; staying active; and having fun. Nothing wrong with going slow, and in fact long-slow-distance is likely the best training. In other words likely best to go on long relaxed rides for maximum health benefits.

I wish I could have my Ti Basso (Litespeed Classic) frame widened… My max tire width is a 28mm…

Cal

Calzone

Gear Whore #1

With the ECB raising rates .5% today despite the Credit Suisse problem, what do you think the FED will do next week to follow suit?

My bet would be a small rate increase of .25% after all the bantering and posturing for maybe a .5% hike that caused mucho volatility last week. Not so sure keeping rates flat, which is what many on the street are speculating and what is being perhaps priced into the market.

Powel really is professionally a lawyer. How did he become FED Chair?

My feeling is that inflation might be more important to target than financial stability, and selfishly in my own best interest as a retired person, a downturn or recession is required to get on top of the mess that basically was created by the government and the FED, meaning inflation.

The ECB made its move: now the FED next week. My bet is Powel and the FED will follow the ECB’s move today. The unintended consequence could be more bank trouble… but I already know that will happen sooner or later. Meanwhile inflation is the sticky problem…

After reading Ray Dalio’s most recent book on the changing world order that describes the rise and fall of empires, pretty much an end game is outlined of the sudden rapid collapse that happens.

Like the quote from the Great Gatsby, that ”bankruptcy happens slowly and then suddenly:” know that this is occurring now.

“Ka-boom,” went the bank… but instead of banks going bankrupt it will be countries eventually.

Also I know that the debt being created to offset the bank’s loses is like indenturing the public by saddling each person with debt. The money has to come from somewhere… Also this will eventually translate into less freedom and liberty…

Cal

My bet would be a small rate increase of .25% after all the bantering and posturing for maybe a .5% hike that caused mucho volatility last week. Not so sure keeping rates flat, which is what many on the street are speculating and what is being perhaps priced into the market.

Powel really is professionally a lawyer. How did he become FED Chair?

My feeling is that inflation might be more important to target than financial stability, and selfishly in my own best interest as a retired person, a downturn or recession is required to get on top of the mess that basically was created by the government and the FED, meaning inflation.

The ECB made its move: now the FED next week. My bet is Powel and the FED will follow the ECB’s move today. The unintended consequence could be more bank trouble… but I already know that will happen sooner or later. Meanwhile inflation is the sticky problem…

After reading Ray Dalio’s most recent book on the changing world order that describes the rise and fall of empires, pretty much an end game is outlined of the sudden rapid collapse that happens.

Like the quote from the Great Gatsby, that ”bankruptcy happens slowly and then suddenly:” know that this is occurring now.

“Ka-boom,” went the bank… but instead of banks going bankrupt it will be countries eventually.

Also I know that the debt being created to offset the bank’s loses is like indenturing the public by saddling each person with debt. The money has to come from somewhere… Also this will eventually translate into less freedom and liberty…

Cal

Last edited:

Calzone

Gear Whore #1

Phil,

Went for a “stroll” with the grandson to the post office. He loves being outside.

Expect your cranks to be delivered on Monday according to the USPS.

Interesting the new protocol on only using cash for transactions if exact change.

The world is much changed $0.64 for a stamp. Ouch…

Cal

Went for a “stroll” with the grandson to the post office. He loves being outside.

Expect your cranks to be delivered on Monday according to the USPS.

Interesting the new protocol on only using cash for transactions if exact change.

The world is much changed $0.64 for a stamp. Ouch…

Cal

Rayt

Nonplayer Character

I was sympathetic to KoFe’s situation. In his context the offshoring was about greed, but it was also about policy (now failed government policy:globalization).

I was in the business and believe me it’s all about greed. Do you as a New Yorker in the fashion industry remember the bad old garment district days and sweat shops? Think the same vultures but they are now global. If we ever meet I’ll tell you all about it. American greed is exceptional.

Calzone

Gear Whore #1

Ray,

The fraud that I was referencing was specific to the housing crisis where not only greed was involved.

Fraud was involved, but no one went to jail.

I worked at a hospital, and PhD’s getting their training pretty much were paid so little that housing had to be provided. This was exploitative and kinda reminded me of “Share-Cropping” and off shoot of slavery. I found it interesting how exploitative this system was and it was akin to slavery.

My father was an illegal immigrant so pretty much I grew up knowing how oppressive capitalism can be.

Cal

The fraud that I was referencing was specific to the housing crisis where not only greed was involved.

Fraud was involved, but no one went to jail.

I worked at a hospital, and PhD’s getting their training pretty much were paid so little that housing had to be provided. This was exploitative and kinda reminded me of “Share-Cropping” and off shoot of slavery. I found it interesting how exploitative this system was and it was akin to slavery.

My father was an illegal immigrant so pretty much I grew up knowing how oppressive capitalism can be.

Cal

Rayt

Nonplayer Character

I think it was Chomsky who said capitalism is essentially debt and wage slavery where we work all our lives to break even when we die.

Calzone

Gear Whore #1

Baby sat the grand kids at their house. I have a great appreciation of the comfort of my own house and the lack of clutter that I experience at the grand kid’s house.

Had the opportunity to move almost all the 2 cubic yards of gravel from the driveway to the back-backyard. I have about a half yard extra that I loaded into containers and a “man-bag” that I can use to terrace in some gravel steps boxed with pressure treated lumber.

Also the two 8 foot lengths of cedar fencing were delivered Friday. Pretty much need to secure the backyard because of the grand kids.

Started my high fat diet. Tonight a grilled Salmon steak and brown rice. Had a Duncan Donuts sourdough breakfast sandwich that had bacon, and a Bacon Turkey Bravo for lunch from Panera. Generally though we don’t eat out.

No Ground Hog sightings this year, but I dug up a fresh tunnel out on the “table” in the back-backyard. This also happened last year, and I dug up the tunnel which was fresh, but found no ground hog in residence. Last year this discouraged him digging in, so I hope the same happens this year. Basically he was my neighbor’s problem.

BTW the gravel is so no critters set up home under my sheds, as well as drainage.

Today I heard the Spring Peepers starting their orgy.

Cal

Had the opportunity to move almost all the 2 cubic yards of gravel from the driveway to the back-backyard. I have about a half yard extra that I loaded into containers and a “man-bag” that I can use to terrace in some gravel steps boxed with pressure treated lumber.

Also the two 8 foot lengths of cedar fencing were delivered Friday. Pretty much need to secure the backyard because of the grand kids.

Started my high fat diet. Tonight a grilled Salmon steak and brown rice. Had a Duncan Donuts sourdough breakfast sandwich that had bacon, and a Bacon Turkey Bravo for lunch from Panera. Generally though we don’t eat out.

No Ground Hog sightings this year, but I dug up a fresh tunnel out on the “table” in the back-backyard. This also happened last year, and I dug up the tunnel which was fresh, but found no ground hog in residence. Last year this discouraged him digging in, so I hope the same happens this year. Basically he was my neighbor’s problem.

BTW the gravel is so no critters set up home under my sheds, as well as drainage.

Today I heard the Spring Peepers starting their orgy.

Cal

Calzone

Gear Whore #1

Ray,

I believe that. We are all indentured by the deficeit and paying for the greed of the banksters.

All the bailouts got “Socialized” meaning the tax payer is paying for the loses from 2007-2008.

Another way to look at it is the future is “mortgaged” because the debt has to be paid off sometime.

Cal

I believe that. We are all indentured by the deficeit and paying for the greed of the banksters.

All the bailouts got “Socialized” meaning the tax payer is paying for the loses from 2007-2008.

Another way to look at it is the future is “mortgaged” because the debt has to be paid off sometime.

Cal

Last edited:

Share:

-

This site uses cookies to help personalise content, tailor your experience and to keep you logged in if you register.

By continuing to use this site, you are consenting to our use of cookies.